4.5.2017

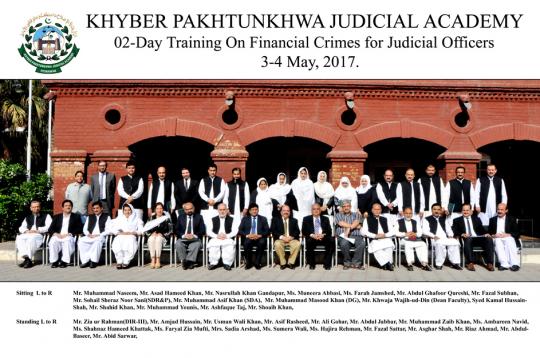

Two days(3rd and 4th May 2017) Training course on Financial Crimes for Judicial officers was held at KP Judicial Academy Peshawar. Thirty DJs and ADJs across the province of KP participated in the Training course. Concluding ceremony was held at KP Judicial Academy and Director General KP Judicial Academy Muhammad Masood Khan along with Senior Director Administration, Muhammad Asif Khan , Dean Faculty Khowaja wajihuddin and other officers of KP Judicial Academy attended the ceremony.

Addressing the concluding ceremony DG ,KP Judicial Academy, Muhammad Masood Khan stated that financial and economic crime has posed a great threat to the sustainable development of all the developing economies of the world.

He stated that in the developed world, the impact of such crimes may be easier to contain, given the size of their economies and their ability to install appropriate regulatory mechanisms. In the developing world, however, the long-term impact on and costs for sustainable development are significantly higher as a result of weak regulatory frameworks and limited government capacity.

DG KP Judicial Academy said that the objective of the two day Training course was that the participants (Judicial officers) understand the basic concept of financial crime; Identify the economic impacts of financial crime on economic development; Examine the legal mandate and practical implications of committees and Financial Monitoring Unit under Section 5,6 of the AML Act VII of 2010, to combat money laundering and terrorist financing; and summarize the legal requirements and preventive measures to be adopted to combat financial and electronic crime; analyze a case study on AML Act, 2010 and Khanani & Kalia Forex Scam case andHSBC Money Laundering Case, The Bank of Credit and Commerce International (BCCI)

Addressing the Audience the Dean Faculty, KP Judicial Academy, Khowaja Wajihuddin stated that financial crime over the last 30 years has increasingly become the concern of governments throughout the world. This concern arises from a variety of issues because the impact of financial crime varies in different contexts. It is today widely recognized that the prevalence of economically motivated crime in many societies is a substantial threat to the development of economies and their stability.

He stated that due to the often complex nature of financial services, detecting and preventing fraud within the financial sector poses an almost insurmountable challenge. The threats are both domestic and international.

He said that several law enforcement agencies are responsible for enforcing financial crimes laws. The National Accountability Bureau (NAB), the Anti-Narcotics Force (ANF), the Federal Investigative Agency (FIA), and the Directorate of Customs Intelligence and Investigations (CII) all oversee Pakistan’s d financial enforcement efforts. In addition to The prevention of Electronic crimes Act,2016,the 2007 Anti-Money Laundering Ordinance followed by Anti Money Laundering Act,2010 are major laws in these areas which include the Anti-Terrorism Act of 1997, which defines the crime of terrorist finance and establishes jurisdiction and punishments; the National Accountability Ordinance of 1999, which requires financial institutions to report corruption related suspicious transactions to the NAB and establishes accountability courts; and the Control of Narcotics Substances Act of 1997 which criminalizes acts of money laundering associated with drug offenses and requires the reporting of narcotics related suspicious transactions.

At the end participants were awarded with Certificates by the DG KP Judicial Academy Muhammad Masood Khan.

KP Judicial Academy

Copyright©2013-2025, Khyber Pakhtunkhwa Judicial Academy, Old Sessions Court Building, Jail Road, Peshawar (2500), Khyber Pakhtunkhwa, Pakistan

Contact us

- Phone: +92-91-9214252 / 9210744-8

- Fax: +92.91.9210929

- info@kpja.edu.pk

- www.kpja.edu.pk .

- All Staff Contact List

Zircon - This is a contributing Drupal Theme

Design by WeebPal.

Design by WeebPal.